Finance

The Finance Department is responsible for processing accounts payable, accounts receivable, and payroll; collecting, analyzing, and reporting financial data; reporting such data to Town management, creditors, and the general public in accordance with generally accepted accounting principles; and investment portfolio and debt management.

The Finance Department is also responsible for collecting taxes, which include lodging tax, sales tax, short-term rental excise tax, and a transfer tax on real estate investment fees. Additionally, the Finance Department administers all water billing and manages the annual budget process.

Budget & Financial Reporting

Learn about the Town of Frisco’s annual budget process and financial reporting which is conducted monthly and annually. View the approved budget, Annual Comprehensive Financial Report, and The Frisco Community Report.

Business Licenses

The Town of Frisco requires any person operating and maintaining any business within the town, including the delivery of goods within the town, which are purchased or contracted for outside the corporate limits of the Town, to obtain an annual business license. Learn how to apply and the requirements for obtaining a business license.

Sales & Lodging Tax

The Town of Frisco is a self-collecting sales tax jurisdiction. As such, Town sales tax, should be remitted directly to the Town of Frisco. The Town also collects taxes on lodging, nicotine, and short-term rentals. Learn about tax rates and how to remit specific taxes.

How To Pay Town of Frisco Bills Online

Learn how to pay Town of Frisco bills online, including water bills, business license renewals, business taxes, and tickets issued by the Frisco Police Department.

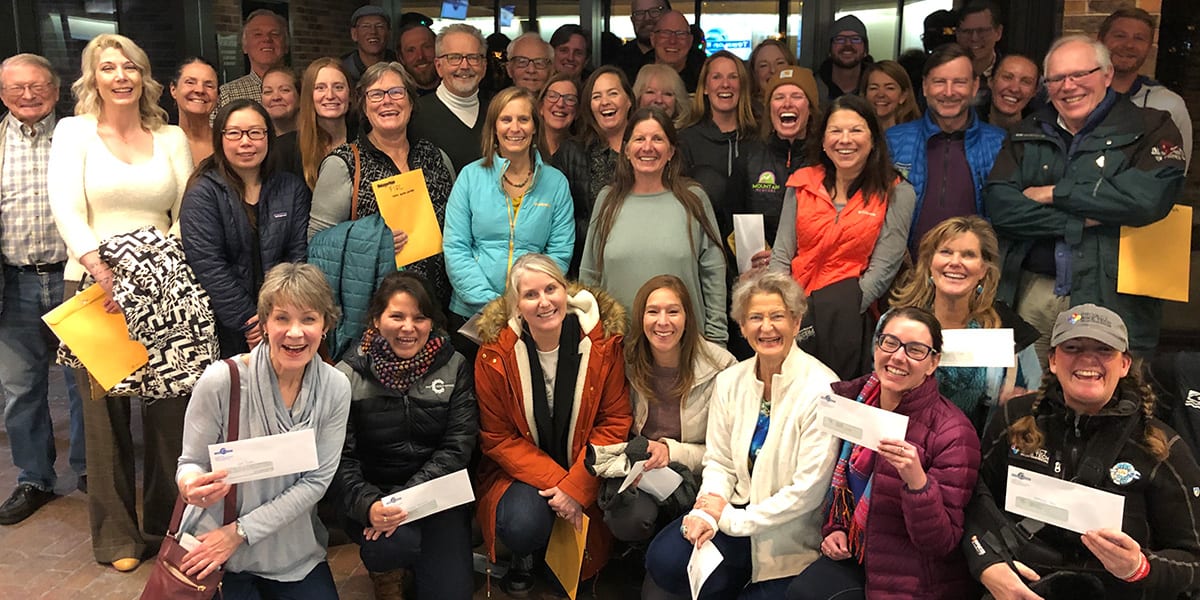

Non-Profit Grants

The Town of Frisco is proud to offer support to our local non-profits through a yearly grant process. Every year the Town provides an opportunity for non-profits seeking support to apply through a county-wide grant program and the Town of Frisco Community Impact Grant.

Real Estate Investment Fees (REIF)

The Town of Frisco levies a 1% Real Estate Investment Fee (commonly referred to as a transfer tax) on the transfer of all real property located within municipal limits. The fee is calculated based on the total consideration paid for the transfer of interest in the property and is due upon closing.

Short-Term Rentals in Frisco

Anyone renting their Frisco property, or seeking to rent a property in Frisco, for less than a consecutive thirty-day period, is required to have a Short-Term Rental License and should be aware of the town’s regulations for Short-Term Rentals (STR).